High Stakes in the U.S.-China AI Chip Race: China’s decision to use domestic AI chips instead of buying from Nvidia signals progress — and newfound confidence — in its own semiconductor industry.

Last week, China barred its major tech companies from buying Nvidia chips.

Dear friends,

Last week, China barred its major tech companies from buying Nvidia chips. This move received only modest attention in the media, but has implications far beyond what’s widely appreciated. Specifically, it signals that China has progressed sufficiently in semiconductors to break away from dependence on advanced chips designed in the U.S., the vast majority of which are manufactured in Taiwan. It also highlights the U.S. vulnerability to possible disruptions in Taiwan at a moment when China is becoming less vulnerable.

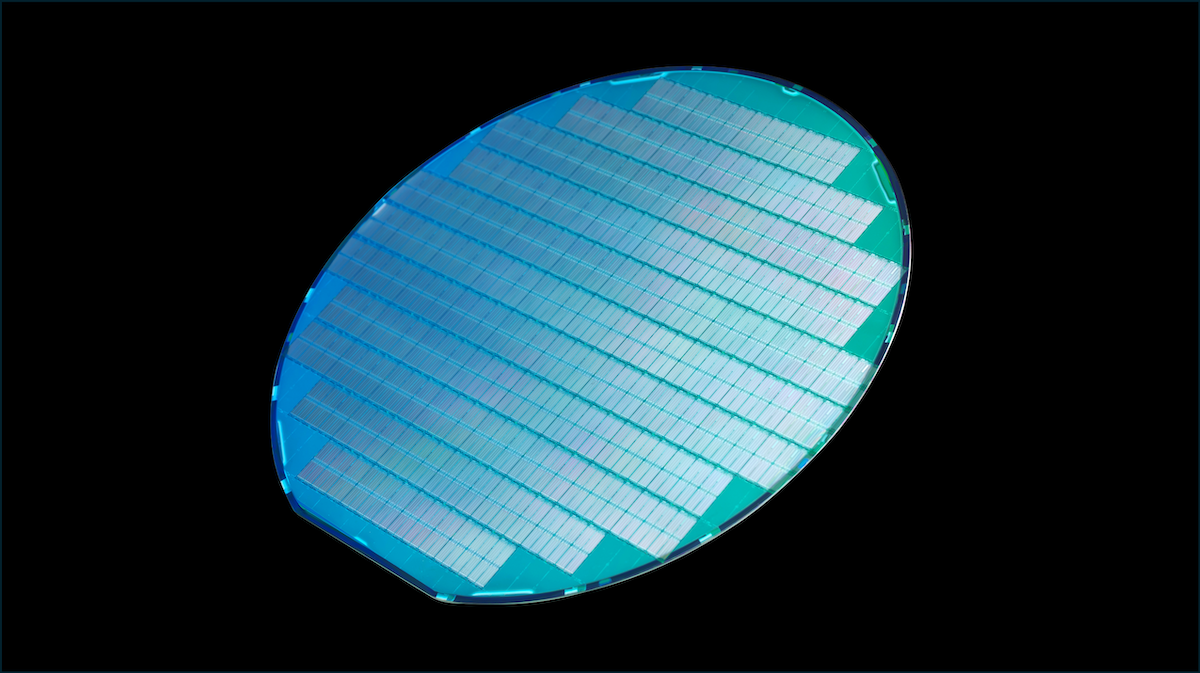

After the U.S. started restricting AI chip sales to China, China dramatically ramped up its semiconductor research and investment to move toward self-sufficiency. These efforts are starting to bear fruit, and China’s willingness to cut off Nvidia is a strong sign of its faith in its domestic capabilities. For example, the new DeepSeek-R1-Safe model was trained on 1000 Huawei Ascend chips. While individual Ascend chips are significantly less powerful than individual Nvidia or AMD chips, Huawei’s system-level design approach to orchestrating how a much larger number of chips work together seems to be paying off. For example, Huawei’s CloudMatrix 384 system of 384 chips aims to compete with Nvidia’s GB200, which uses 72 higher-capability chips.

Today, U.S. access to advanced semiconductors is heavily dependent on Taiwan’s TSMC, which manufactures the vast majority of the most advanced chips. Unfortunately, U.S. efforts to ramp up domestic semiconductor manufacturing have been slow. I am encouraged that one fab at the TSMC Arizona facility is now operating, but issues of workforce training, culture, licensing and permitting, and the supply chain are still being addressed, and there is still a long road ahead for the U.S. facility to be a viable substitute for manufacturing in Taiwan.

If China gains independence from Taiwan manufacturing significantly faster than the U.S., this would leave the U.S. much more vulnerable to possible disruptions in Taiwan, whether through natural disasters or man-made events. If manufacturing in Taiwan is disrupted for any reason and Chinese companies end up accounting for a large fraction of global semiconductor manufacturing capabilities, that would also help China gain tremendous geopolitical influence.

Despite occasional moments of heightened tensions and large-scale military exercises, Taiwan has been mostly peaceful since the 1960s. This peace has helped the people of Taiwan to prosper and allowed AI to make tremendous advances, built on top of chips made by TSMC. I hope we will find a path to maintaining peace for many decades more.

But hope is not a plan. In addition to working to ensure peace, practical work lies ahead to multi-source, build more chip fabs in more nations, and enhance the resilience of the semiconductor supply chain. Dependence on any single manufacturer invites shortages, price spikes, and stalled innovation the moment something goes sideways.

Keep building,

Andrew